US Inflation Hits 2.7% – Economic Analysis

🇺🇸 US Inflation Rises to 2.7%, Exceeding Forecasts in June 2025

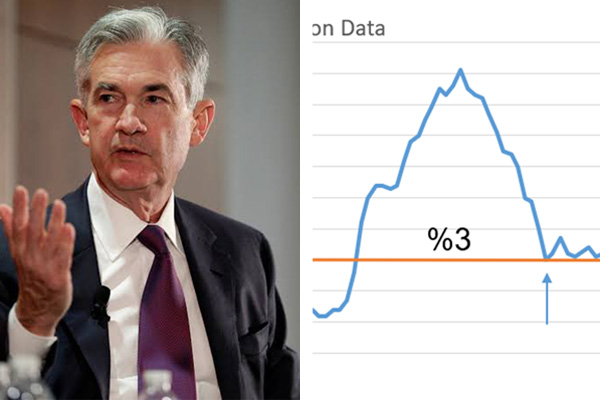

Washington, D.C. — The U.S. economy received a jolt this morning as the Consumer Price Index (CPI) data for June 2025 revealed a year-over-year inflation rate of 2.7%, outpacing analyst expectations of 2.4%. The unexpected uptick signals persistent inflationary pressures and reignites debates about the Federal Reserve’s interest rate trajectory.

June CPI Report: Breakdown of Key Data

The Bureau of Labor Statistics released the latest CPI report on July 15, 2025. Key highlights include:

- Overall CPI (YoY): 2.7%

- Core CPI (excluding food and energy): 3.1%

- Energy prices: Up 5.6% from May, largely driven by rising oil prices

- Food prices: Increased by 2.3% year-over-year

- Services sector inflation: Grew by 3.8%, indicating wage pressure

This marks the highest inflation reading since January 2025, reversing a months-long downward trend.

How Financial Markets Reacted

The surprise inflation reading triggered swift movements across financial markets:

- 📉 Dow Jones: Dropped 1.1% shortly after the announcement

- 💵 US Dollar Index (DXY): Rose 0.6% as rate hike bets increased

- 📈 10-Year Treasury Yield: Climbed to 4.38%

- 💻 Tech stocks: Especially sensitive to interest rates, saw sharp declines

“Markets had priced in a cooldown — this reading changes everything,” said Anna Mendez, senior strategist at Apex Capital.

What Will the Federal Reserve Do?

With inflation still above the Fed’s 2% target, policymakers now face increased pressure. According to CME FedWatch data:

- 🧾 Probability of a rate hike in September jumped from 30% to 55%

- 🎙️ Fed Chair Jerome Powell is expected to address inflation concerns in a press briefing this week

Some economists suggest that the Fed may adopt a more cautious tone, potentially slowing rate cuts previously expected in Q4 2025.

How Consumers Will Feel the Pressure

Beyond Wall Street, Main Street is also feeling the impact:

- Grocery bills: Continue creeping higher, particularly for meat and dairy

- Gasoline prices: Up 8% from the prior month

- Mortgage rates: Holding steady above 7%, deterring homebuyers

Consumers already battling affordability issues could face increased borrowing costs and reduced purchasing power.

Global Reactions to US Inflation Surge

International markets took notice:

- 🌍 European Central Bank members signaled caution as US trends may influence EU inflation

- 🇯🇵 The Bank of Japan reaffirmed its commitment to ultra-loose policy, citing different domestic dynamics

- 💰 Emerging markets currencies saw renewed volatility amid dollar strength

The US remains a barometer for global monetary strategy, and this report only magnifies its influence.

Outlook: What’s Next for the US Economy?

With inflation rising again, analysts are revising their forecasts:

- Goldman Sachs: Pushes back first Fed rate cut to March 2026

- Moody’s: Cautions risk of "inflation entrenchment" if wages remain elevated

- Consumer Sentiment: Fell to a 4-month low, according to University of Michigan data

Whether this is a temporary spike or the start of a new trend will depend on upcoming wage and employment data. For now, policymakers — and markets — are on high alert.