PayPal Stock: When Wall Street Makes the Cross - The Broken Bull Rally That Crashed in 24 Hours

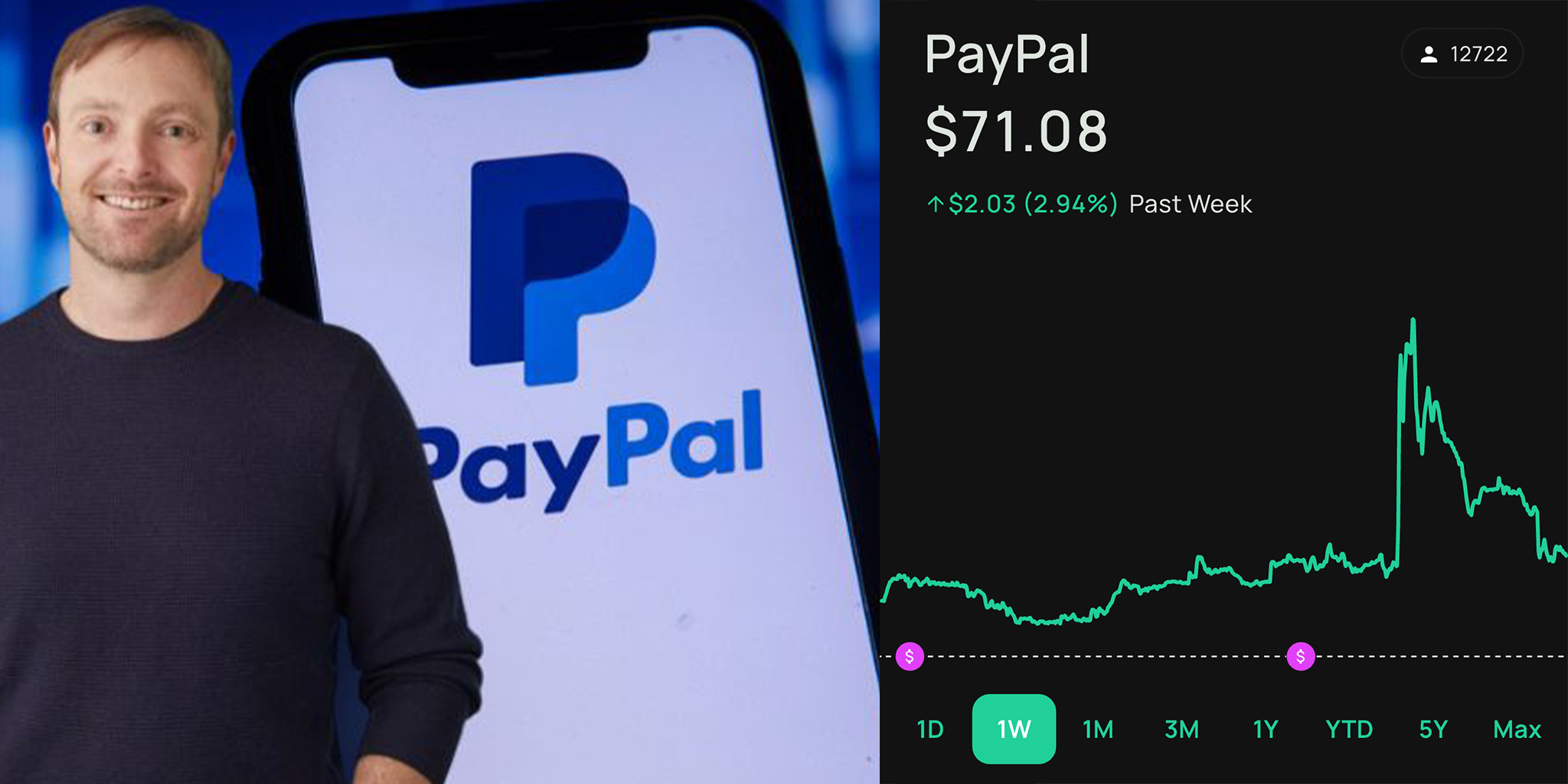

$PYPL is broken. There's no other way to put it. Yesterday's euphoric 17% spike—triggered by better-than-expected Q3 earnings, a ChatGPT integration deal with OpenAI, and the company's first-ever dividend—has evaporated like morning fog. Today, PayPal stock is trading back near $73-75, barely above Monday's closing price of $70.25, and investors who chased the rally are nursing fresh wounds.

This isn't just a normal pullback. This is what happens when Wall Street makes the cross on a once-dominant company—when institutional investors collectively decide that no amount of good news can overcome fundamental concerns about the business model, competitive positioning, and long-term growth trajectory.

1. The Earnings That Should Have Worked

On the surface, PayPal's Q3 2025 earnings report looked like exactly what the doctor ordered for a stock that's been left for dead. The numbers were genuinely impressive:

Q3 2025 PayPal Results:

- EPS: $1.34 (vs. $1.19 consensus) - Beat by 12.6%

- Revenue: $8.42 billion (vs. $8.26 billion expected) - Beat by 2%

- Revenue growth: 7.3% year-over-year

- Transaction margin: $3.9 billion, up 6%

- Total payment volume: $458.1 billion, up 8.4%

- Active accounts: 438 million, up 1.4%

The OpenAI Bombshell

But the real headline wasn't the earnings—it was the strategic partnership with OpenAI announced simultaneously. Starting in 2026, PayPal will be embedded directly into ChatGPT, enabling AI-powered shopping and instant checkout for hundreds of millions of users. CEO Alex Chriss positioned this as PayPal's entry into "agentic commerce"—AI agents autonomously completing purchases on behalf of users.

The market's initial reaction was ecstatic. PYPL shares rocketed 15-17% in pre-market and early trading, briefly touching $80.52—the highest level since February 2025. Analysts scrambled to upgrade their price targets. CNBC's Jim Cramer declared the company had "a path to multiple years of upside."

And then... it all fell apart.

2. The 24-Hour Collapse: From Hero to Zero

By the end of Tuesday's trading session, the gains had already begun eroding. By Wednesday morning—less than 24 hours after the earnings euphoria—PayPal stock had surrendered virtually the entire rally. The chart tells a devastating story:

- Monday close: $70.25

- Tuesday peak: $80.52 (up 14.6%)

- Wednesday trading: $73-75 range (effectively flat from Monday)

In percentage terms, that's a round-trip from nowhere back to nowhere—a complete rejection of what should have been transformative news. Traders who bought into the excitement are now underwater. Long-term holders remain trapped in a stock that's still down more than 10% year-to-date while the S&P 500 has climbed over 10%.

The Intraday Massacre

What makes this collapse particularly brutal is the speed and violence of the reversal. This wasn't a gradual fade over weeks—it was an aggressive, high-volume selloff that obliterated buyer enthusiasm in hours. Option traders who bet on continued upside got crushed. Technical traders who bought the breakout above $80 triggered their stop-losses in panic.

The message from the market is unmistakable: Nobody believes in PayPal's story anymore.

3. When a Stock Is "Broken": Understanding the Psychology

Wall Street has a term for stocks like PayPal: "broken names" or "show-me stories." These are companies that have disappointed investors so many times that even legitimately good news is met with immediate skepticism and selling.

The Pattern of Broken Stocks

PayPal has exhibited this pattern repeatedly over the past year:

- Q2 2025: Stock dropped 8.7% after earnings despite beating expectations

- Q1 2025: Modest rally quickly faded despite improved metrics

- Q4 2024: Another post-earnings decline despite guidance raise

- Pattern: Three out of four recent earnings reports resulted in stock declines

This is the definition of a broken stock. Good news doesn't stick. Bad news accelerates selling. And neutral news is treated as bad news. Once a stock enters this psychological zone, escaping requires something truly extraordinary—and even the OpenAI partnership apparently doesn't qualify.

Why Stocks Stay Broken

Several factors keep stocks trapped in this purgatory:

- Institutional disinterest: Large funds have moved on to other opportunities

- Momentum traders absent: No sustained buying pressure to drive upward momentum

- Skeptical overhang: Every rally attracts sellers looking to exit positions

- Narrative failure: The market doesn't believe management's turnaround story

- Technical damage: Repeated failures at resistance levels create self-fulfilling selling

PayPal checks every single box.

4. The Real Problems Wall Street Sees

So why doesn't the market believe? Despite the positive earnings and flashy announcements, several deep-seated concerns continue plaguing PayPal:

Slowing Transaction Growth

While total payment volume grew 8.4%, the number of actual transactions declined 4.5% year-over-year to 6.33 billion. That's a concerning divergence—higher volume but fewer transactions suggests PayPal is increasingly handling larger B2B payments while losing ground in consumer transactions.

Payment transactions per active account also dropped 6.2% to just 57.6 annually. This indicates declining engagement—users are transacting less frequently through PayPal, a worrying trend for a payments platform.

Margin Compression Fears

While transaction margin grew 6%, the margin rate actually shrank 60 basis points to 46%. The company is generating more absolute dollars but at lower profitability per transaction. This raises questions about whether PayPal is having to cut prices or offer more promotions to compete.

Competitive Pressure Intensifies

PayPal faces brutal competition from multiple directions:

- Apple Pay and Google Pay: Dominating mobile point-of-sale

- Buy Now, Pay Later competitors: Klarna, Affirm eating into PayPal's BNPL market share

- Stripe and Adyen: Winning enterprise merchant services contracts

- Banks fighting back: Zelle and bank-to-bank transfers reducing PayPal relevance

- Crypto payments: Blockchain-based solutions threatening long-term disruption

The OpenAI partnership, while splashy, doesn't address any of these competitive threats directly.

The Venmo Monetization Struggle

PayPal has been trying to monetize Venmo for years with limited success. While Venmo revenue grew over 20% in Q3, the company still doesn't disclose actual revenue figures—suggesting they remain relatively small. Total payment volume through Venmo increased 12%, but converting social payment users into revenue-generating customers has proven frustratingly difficult.

Management Credibility Issues

CEO Alex Chriss took over in September 2023 with promises of a dramatic turnaround. Nearly 18 months later, the stock is down significantly from when he started. While operational metrics have improved modestly, the market clearly doesn't believe the turnaround narrative—and yesterday's earnings reaction proves it.

5. Why the OpenAI Partnership Isn't a Game-Changer

Let's address the elephant in the room: the ChatGPT integration that was supposed to revolutionize PayPal's prospects. Why didn't it work?

No Revenue Until 2026

The partnership doesn't even launch until 2026—meaning any revenue impact is at least a year away and highly speculative. In fast-moving tech markets, that might as well be a decade. Investors want to see results now, not promises about future AI integration.

Uncertain Monetization

How exactly does PayPal make money from this? Will they charge transaction fees? Take a percentage of AI-facilitated commerce? Nobody knows—because PayPal hasn't specified the business model. Without clear monetization mechanics, investors are right to be skeptical.

Competitive Risks

What's to stop Amazon, Apple, Google, or Stripe from launching similar AI shopping integrations? PayPal doesn't have exclusive rights to the concept of AI-powered commerce. If anything, those competitors have stronger positions in consumer shopping behavior and could execute similar strategies more effectively.

AI Hype Fatigue

The market has become increasingly cynical about companies slapping "AI" labels on everything. After watching dozens of companies pump stock prices with AI announcements only to deliver minimal results, investors have developed healthy skepticism. PayPal's "agentic commerce" buzzwords sound great in press releases but mean little without demonstrated business impact.

6. Technical Analysis: The Charts Don't Lie

From a technical perspective, PayPal's price action tells a damning story:

Failed Breakout Pattern

Tuesday's surge above $80 represented a potential breakout above a multi-month resistance level. The immediate rejection and collapse back below $75 is textbook technical failure—often one of the most bearish patterns in trading. It demonstrates that even at these depressed levels, there are more sellers than buyers waiting to unload shares.

Loss of Key Moving Averages

PYPL has been trading below its 50-day and 200-day moving averages for extended periods this year. These are critical technical indicators that institutional trading algorithms use to determine positioning. When a stock persistently trades below major moving averages, it signals fundamental weakness and attracts continued selling pressure.

Declining Volume on Rallies

A healthy bull move requires increasing volume as the stock rises, demonstrating growing conviction. PayPal's rallies—including yesterday's—often occur on relatively weak volume, while selloffs happen on heavy volume. This "volume profile" indicates that rallies are driven by short-covering and speculation, while declines reflect genuine institutional selling.

The $55-$95 Range Prison

For most of 2025, PYPL has been trapped in a $55-$95 trading range, repeatedly failing to break out to the upside. Currently trading in the low-$70s, the stock sits closer to the bottom than the top of that range—and yesterday's failure suggests the ceiling remains firmly intact.

7. Comparing to Other Fallen Tech Giants

PayPal isn't the first once-dominant tech company to fall from grace. The pattern is distressingly familiar:

The IBM Syndrome

IBM spent years as a "broken stock" despite reasonable earnings and repeated transformation promises. The market simply stopped believing the story. Sound familiar?

The Intel Parallel

Intel was the undisputed chip leader until it wasn't. Despite decent earnings for years, the stock languished as investors recognized the company had lost its competitive edge to NVIDIA, AMD, and TSMC. PayPal's loss of payments dominance to Apple, Stripe, and others follows a similar trajectory.

The eBay Precedent

Particularly ironic: eBay—PayPal's former parent company—has itself become a broken stock, unable to compete with Amazon and modern marketplaces despite reasonable profitability. The company PayPal was spun off from in 2015 now trades at similar depressed valuations, stuck in similar competitive quicksand.

8. The First Dividend: Desperation or Confidence?

PayPal's announcement of its first-ever quarterly dividend of $0.14 per share deserves scrutiny. Is this a sign of financial strength and shareholder friendliness—or something more concerning?

The Optimistic View

Bulls argue the dividend demonstrates:

- Strong free cash flow generation ($2.3 billion in Q3 alone)

- Management confidence in sustainable profitability

- Commitment to returning value to shareholders

- Maturation from growth stock to income-generating investment

The Pessimistic View

Bears see something more troubling:

- Admission of limited growth: Companies initiate dividends when they can't find better uses for capital

- Attracting different investors: Trying to pivot from growth investors (who've abandoned the stock) to income investors

- Financial engineering: Using cash returns to prop up share price when business performance can't

- The "mature company" trap: Signaling PayPal's best growth days are behind it

The market's reaction—immediate selling—suggests investors view the dividend more cynically than optimistically.

9. When Wall Street Makes the Cross: The Unforgiving Truth

There's a concept in markets called "loss of confidence," and once it sets in, it's extraordinarily difficult to reverse. Here's why:

Institutional Memory

Large institutional investors—the mutual funds, pension funds, and hedge funds that drive 70% of trading volume—have long memories. They remember:

- PayPal's repeated guidance disappointments

- Multiple failed turnaround initiatives

- Increasing competitive losses

- Management overpromising and underdelivering

These institutions have moved on. Their capital is now allocated to AI leaders like NVIDIA, cloud giants like Microsoft, or fintech disruptors like Block. They're not coming back to PayPal just because of one good quarter.

The Valuation Trap

Even at current levels, PYPL trades at approximately 16x forward earnings—not particularly cheap for a company growing revenue at mid-single digits. For the stock to re-rate higher, PayPal would need to demonstrate:

- Sustained double-digit revenue growth (not happening)

- Margin expansion (going the wrong direction)

- Competitive wins against Apple and Stripe (no evidence)

- Multiple quarters of consistent execution (track record says unlikely)

Without those catalysts, why would institutions pay up for PYPL when they can buy faster-growing, more dominant companies elsewhere?

The Opportunity Cost Problem

This is perhaps the most damning issue: even if PayPal executes perfectly and the stock doubles over the next two years, would it outperform alternatives? Probably not. Growth investors can find better opportunities in AI, cloud, and emerging tech. Value investors can find safer dividends in established blue chips. PayPal occupies an uncomfortable middle ground—not cheap enough for deep value, not growing enough for growth investors.

10. The Bull Case: Is There Any Hope?

To be fair, not everyone has given up on PayPal. Let's examine what bulls are still hanging their hats on:

Massive Free Cash Flow

PayPal generated $2.3 billion in adjusted free cash flow in Q3 alone, putting it on track for well over $8 billion annually. That's real money that could fund acquisitions, buybacks, dividends, and growth investments. Bulls argue this cash generation is underappreciated.

Deeply Oversold

From a contrarian perspective, PayPal's sustained underperformance means expectations are extremely low. If the company can string together a few quarters of consistent execution, the stock could re-rate quickly. The Q3 surge—even though it failed—demonstrates the explosive upside potential if sentiment shifts.

M&A Target Potential

At current valuations, PayPal could become an attractive acquisition target for larger tech companies or financial institutions looking to bolster their payment capabilities. Apple, Amazon, or major banks might see strategic value in owning PayPal's infrastructure and customer base.

Crypto and Stablecoin Opportunity

PayPal has been investing heavily in cryptocurrency and stablecoin infrastructure. If crypto payments gain mainstream adoption, PayPal is positioned to benefit. The company's stablecoin, PYUSD, has seen growing adoption—though from a very small base.

11. The Verdict: What Should Investors Do?

So where does this leave PayPal investors—both current shareholders nursing losses and potential buyers tempted by the depressed valuation?

For Current Shareholders

If you're already holding PYPL with losses, you face a difficult decision:

Hold if:

- You believe in the long-term turnaround thesis (3-5 year horizon)

- You can stomach continued volatility and potential downside

- You view the dividend as acceptable compensation for wait-and-see approach

- You're willing to average down if the stock drops further

Sell if:

- Your thesis has broken—you no longer believe in PayPal's competitive position

- You need to reallocate capital to higher-conviction opportunities

- The opportunity cost of staying invested outweighs potential upside

- You can't afford further drawdowns in your portfolio

For Potential Buyers

The case for buying here isweak but not non-existent:

- Don't chase: Wait for further weakness or clear signs of sustained momentum

- Size appropriately: This is a speculation, not a core holding—position size accordingly

- Have a plan: Set specific price targets and stop-losses before entering

- Be patient: Broken stocks can stay broken for years; don't expect quick gains

The Realistic Timeline

If PayPal is going to truly turn around, it will likely require:

- 6-12 months: Minimum time to demonstrate consistent execution

- 4-6 quarters: Of beating and raising guidance to rebuild credibility

- Clear competitive wins: Tangible evidence of market share gains

- Multiple failed rallies: Shaking out remaining weak hands before sustainable move

This isn't a "buy the dip and profit next quarter" situation. This is a potential multi-year recovery story—if it happens at all.

12. Conclusion: The Harsh Lesson of Broken Stocks

PayPal's spectacular 24-hour round-trip from earnings hero back to zero illustrates one of the market's harshest truths: when Wall Street loses faith in a company, fundamentals stop mattering—at least temporarily.

The stock's violent rejection of good news, groundbreaking partnerships, and improved metrics demonstrates that $PYPL is broken in the psychological sense that matters most to traders and investors. Until the company can string together multiple quarters of consistent execution, competitive wins, and accelerating growth, the stock will likely remain trapped in its current range—rallying on hope, selling on reality.

The OpenAI partnership, the first dividend, the earnings beat—none of it mattered. The market has made its judgment: show me, don't tell me. PayPal is now in the uncomfortable position of having to prove itself quarter after quarter, with no room for error and no benefit of the doubt.

For investors, the lesson is clear: broken stocks stay broken longer than you expect, and they break your heart more times than you can count. Good companies can be bad stocks. Cheap stocks can get cheaper. And when the market makes the cross on a name—when that collective loss of confidence sets in—even the best news can't break the spell.

PayPal may yet recover. Companies do come back from the wilderness. But it won't be easy, it won't be quick, and it certainly won't be the smooth ride that yesterday's 17% surge temporarily promised.

When Wall Street makes the cross, you either need infinite patience or the wisdom to move on. Choose wisely.