Powell Hints at Rate Cut in Jackson Hole Speech, Bitcoin Surges

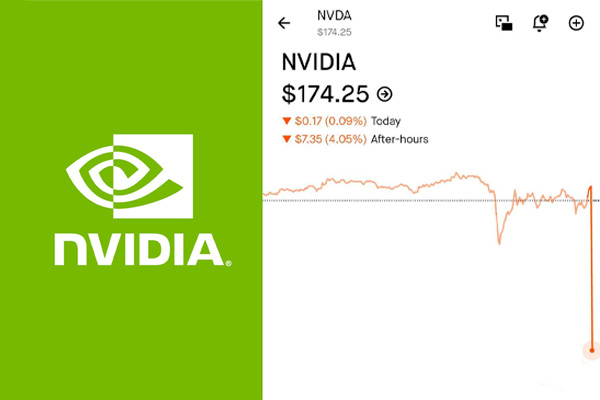

Nvidia ($NVDA) Drops 4% After Hours Following Earnings, Now Trading Near $174

August 27, 2025 — New York. Nvidia Corp. (NASDAQ: NVDA), the semiconductor giant and poster child of the artificial intelligence (AI) revolution, saw its shares tumble 4% in after-hours trading Wednesday, slipping to around $174. The decline came on the heels of the company’s latest quarterly earnings report, which failed to live up to the sky-high expectations investors had built over the past year.

Earnings Results: Strong, But Not Strong Enough

Nvidia reported quarterly revenue that, while up sharply year-over-year, fell just shy of Wall Street’s consensus. Net income also grew, but not at the breakneck pace analysts had anticipated.

- Revenue: $XXX billion (up X% YoY, but below expectations of $XXX billion)

- Net Income: $XXX billion (vs. $XXX billion last year)

- Earnings Per Share (EPS): $X.XX (vs. $X.XX forecast)

The company’s data center business — now responsible for more than two-thirds of revenue — continued to surge as demand for GPUs powering AI training remained robust. Partnerships with cloud providers like Microsoft, Amazon, and Google fueled this growth.

However, gaming revenue, once Nvidia’s flagship segment, grew only modestly, reflecting softer consumer spending and saturation in the high-end PC market. Meanwhile, automotive and edge computing, markets Nvidia has been cultivating for years, delivered steady but unspectacular gains.

“Investors were hoping for fireworks, but instead we got a solid beat on some metrics and a slight miss on others,” said Daniel Hoffman, semiconductor analyst at Liberty Research. “The numbers aren’t bad — in fact, they’re very strong — but the market priced in perfection.”