🇺🇸 US Marshals Reveal the US Government Now Only Holds 28,988 Bitcoin

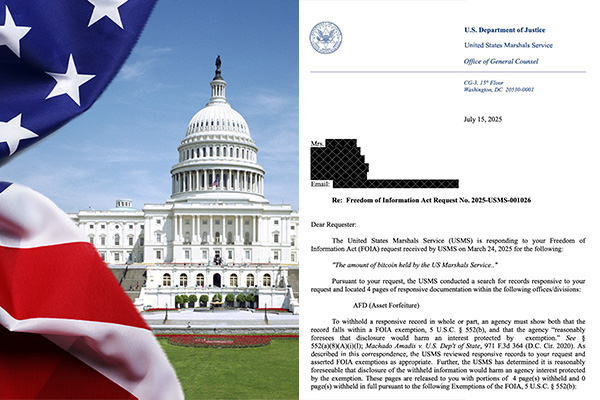

Washington, D.C. — July 16, 2025 — In a surprising disclosure, the U.S. Marshals Service (USMS) has confirmed that the United States Government currently holds just 28,988 BTC, valued at approximately $3.4 billion. This marks a sharp drop from previous estimates suggesting holdings as high as 200,000 BTC.

This unexpected update has raised urgent questions in the crypto community: Has the U.S. Government sold off the majority of its Bitcoin holdings quietly?

What Triggered the Disclosure?

The updated figure was included in a transparency filing by the USMS, as part of a routine quarterly audit. Bitcoin holdings linked to seized criminal assets are typically managed by the U.S. Marshals under federal jurisdiction. However, such a dramatic revision has prompted scrutiny.

Experts believe this update may have been triggered by:

- Internal accounting corrections

- Recent large-scale auctions

- Transfers to undisclosed third-party custody services

Historical Context: Seizures and Auctions

The U.S. Government has historically accumulated Bitcoin through seizures related to:

- Silk Road investigations

- Darknet marketplace shutdowns

- High-profile criminal prosecutions (e.g., Ross Ulbricht, Hydra Market)

From 2014 to 2022, the government conducted several public Bitcoin auctions, selling off tens of thousands of BTC to institutions and wealthy individuals — including Tim Draper, a well-known venture capitalist.

Did They Sell? The Crypto Community Reacts

The revelation has sparked heated debate online, with many asking: Where did the missing BTC go? Here are three prevailing theories:

- Silent Sales or OTC Deals — Government may have sold BTC via over-the-counter markets to avoid public price impact.

- Strategic Transfers — Assets may have been moved to other agencies or under aliases for security purposes.

- Errors in Past Estimates — Previous projections may have overestimated actual holdings due to outdated records.

Regulatory & Political Implications

This new data comes at a pivotal moment:

- The Crypto Asset Transparency Act (2025) requires improved federal reporting of digital asset holdings.

- Lawmakers have called for hearings to investigate the discrepancy.

Public trust in federal crypto strategy is being tested, especially as the U.S. becomes more engaged with blockchain finance.

Market Impact: How Did Bitcoin React?

Despite the shock, market reactions have been relatively contained:

- Bitcoin (BTC) dropped 1.1%, hovering around $117,000

- Ethereum (ETH) remained stable

Analysts believe the reaction is largely psychological and may intensify if new sales are confirmed.

Industry Voices Weigh In

“If they’ve sold, the market deserves transparency,” said Rachel Wong, Head of Digital Policy at CoinLogic.

“It’s ironic — institutions are buying Bitcoin while the government appears to be offloading,” noted Diego Navarro, a blockchain strategy advisor.

Some see this as part of a broader policy shift in crypto asset management.

What Comes Next?

- Congressional oversight hearings may begin this summer

- Crypto analysts may investigate known federal BTC wallets via blockchain forensics

- Transparency watchdogs demand full disclosure of historical BTC sales

With Bitcoin ETFs and CBDC initiatives rising, this may reflect a deeper strategic reorientation.