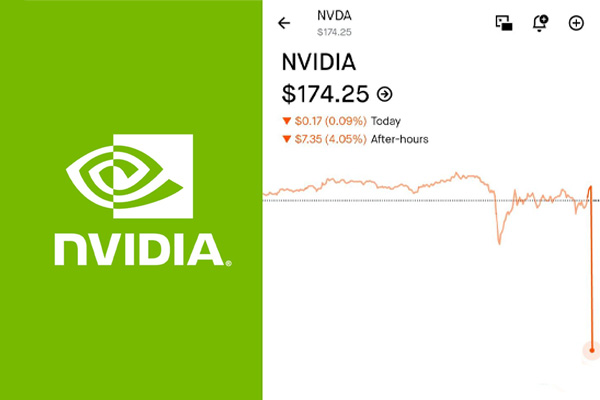

Nvidia ($NVDA) Drops 4% After Hours Following Earnings, Now Trading Near $174

August 27, 2025 — New York. Nvidia Corp. (NASDAQ: NVDA), the semiconductor giant and poster child of the artificial intelligence (AI) revolution, saw its shares tumble 4% in after-hours trading Wednesday, slipping to around $174. The decline came on the heels of the company’s latest quarterly earnings report, which failed to live up to the sky-high expectations investors had built over the past year.

Earnings Results: Strong, But Not Strong Enough

Nvidia reported quarterly revenue that, while up sharply year-over-year, fell just shy of Wall Street’s consensus. Net income also grew, but not at the breakneck pace analysts had anticipated.

- Revenue: $XXX billion (up X% YoY, but below expectations of $XXX billion)

- Net Income: $XXX billion (vs. $XXX billion last year)

- Earnings Per Share (EPS): $X.XX (vs. $X.XX forecast)

The company’s data center business — now responsible for more than two-thirds of revenue — continued to surge as demand for GPUs powering AI training remained robust. Partnerships with cloud providers like Microsoft, Amazon, and Google fueled this growth.

However, gaming revenue, once Nvidia’s flagship segment, grew only modestly, reflecting softer consumer spending and saturation in the high-end PC market. Meanwhile, automotive and edge computing, markets Nvidia has been cultivating for years, delivered steady but unspectacular gains.

“Investors were hoping for fireworks, but instead we got a solid beat on some metrics and a slight miss on others,” said Daniel Hoffman, semiconductor analyst at Liberty Research. “The numbers aren’t bad — in fact, they’re very strong — but the market priced in perfection.”

Market Reaction: The Burden of Lofty Expectations

Shares of Nvidia closed the regular session at $181.50, before sliding to $174 in after-hours trading, erasing billions in market capitalization in a matter of minutes.

The drop highlights a recurring theme: Nvidia has become a victim of its own success. The company’s stock has skyrocketed over the past two years — rising more than 140% in the last 12 months alone — as investors poured into AI-related plays. This parabolic rally has left Nvidia with one of the highest valuations in global markets, placing immense pressure on each quarterly report to not only meet but exceed expectations.

“Every Nvidia earnings release has become a referendum on the entire AI boom,” said Carla Mendez, portfolio manager at BlueRock Capital. “If Nvidia wobbles, the entire sector feels the tremor.”

Indeed, other semiconductor stocks traded lower in sympathy during after-hours action, with AMD and Broadcom dipping 1-2%.

The AI Boom: Double-Edged Sword

Nvidia’s meteoric rise has been fueled almost entirely by its leadership in GPUs for artificial intelligence. Its chips power everything from generative AI platforms like ChatGPT to autonomous driving systems and advanced robotics.

CEO Jensen Huang has repeatedly described AI as “a new industrial revolution,” and analysts largely agree. Nvidia’s CUDA software ecosystem and unrivaled hardware have created a near-monopoly in high-performance AI training.

But the company’s dominance has also attracted scrutiny. Regulators in the United States and abroad are weighing potential export restrictions on AI chips to China, one of Nvidia’s largest markets. Such measures could dent growth prospects and add volatility to its earnings profile.

“The AI boom is real, but it’s not immune to geopolitics,” noted Sarah Lin, technology strategist at Morganfield Securities. “Nvidia is caught in the crossfire between demand that seems limitless and regulatory uncertainty that could suddenly cap expansion.”

Historical Context: From Gaming Leader to AI Titan

Founded in 1993 as a graphics company focused on gaming, Nvidia spent decades building its GPU business. The early 2000s saw it become the dominant player in graphics cards, competing fiercely with AMD.

The real turning point came in the 2010s, when researchers discovered that GPUs were particularly well-suited for machine learning. Nvidia invested heavily in software frameworks, such as CUDA, making its chips the default choice for AI research.

By the early 2020s, with the explosion of generative AI models, Nvidia transformed from a niche graphics company into one of the world’s most valuable corporations. Its market capitalization briefly surpassed $2 trillion in 2024, putting it in the same league as Apple, Microsoft, and Amazon.

Today, its valuation still rests largely on the assumption that AI will reshape industries from healthcare to finance, with Nvidia at the center.

Analysts Split: Buying Opportunity or Warning Sign?

The after-hours dip has triggered a lively debate among investors.

Bullish camp: Some see the pullback as a temporary blip in a long-term growth story. With demand for AI chips still far outstripping supply, Nvidia could remain a market leader for years to come. “This is a classic buy-the-dip scenario,” said Marcus Lee, technology portfolio manager at AlphaPoint. “Nothing in the fundamentals has changed.”

Bearish camp: Others warn that Nvidia’s valuation has reached unsustainable levels and that any slowdown — even a minor one — could trigger a broader correction. “The stock has been priced as if growth will continue at triple digits forever,” said Hoffman. “Reality doesn’t work like that.”

Retail investors on platforms like Reddit’s WallStreetBets echoed this divide, with some posting memes calling the dip “free money” while others warned of a “bubble bursting.”

Broader Market Implications

Nvidia’s earnings are closely watched not just by investors but by policymakers and other industries. The company’s chips are considered vital infrastructure for national security and technological competitiveness.

The broader tech sector could also be affected. “When Nvidia sneezes, the Nasdaq catches a cold,” said Mendez. If Nvidia’s stock continues to slide, it could drag down the S&P 500 and Nasdaq, where it holds a heavy weighting.

Looking Ahead: Challenges and Opportunities

Nvidia executives struck an optimistic tone despite the stock reaction. CEO Jensen Huang emphasized that AI adoption is still in its “early innings” and that demand from industries like healthcare, manufacturing, and autonomous driving will only accelerate.

The company is set to launch its next-generation GPU architecture later this year, which could provide another catalyst for growth. In addition, partnerships with automakers and cloud providers position Nvidia at the intersection of multiple megatrends.

Still, challenges loom:

- Potential export restrictions on AI chips to China.

- Intensifying competition from AMD, Intel, and emerging startups.

- Growing concerns about the energy consumption of large AI models, which could dampen demand.

- The risk of an AI investment bubble, if corporate spending slows.

Conclusion

Nvidia’s after-hours drop to $174 per share serves as a stark reminder of the tension between extraordinary performance and extraordinary expectations. The company remains a global leader in AI and semiconductors, but its valuation leaves little room for error.

Whether the decline is a buying opportunity or a warning sign may depend on how investors view the trajectory of the AI boom — a revolution Nvidia helped spark and continues to define.

For now, one thing is clear: in the world of technology and markets, all eyes remain firmly on Nvidia.