Euro Zone July Core Inflation Holds at 2.3%, Matching Forecasts

Brussels, August 20, 2025.

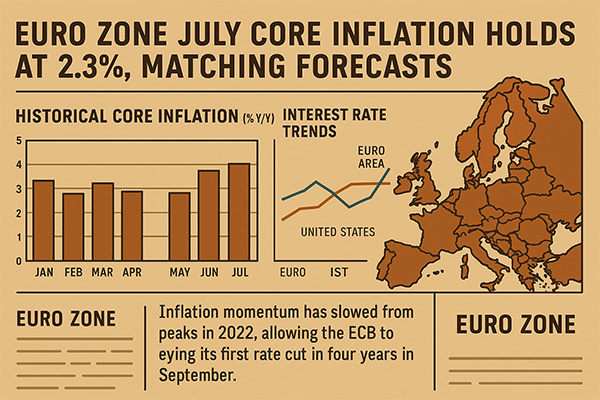

The euro zone’s core inflation rate remained unchanged at 2.3% year-on-year in July, according to Eurostat data released Wednesday. The figure was exactly in line with forecasts and with the previous month’s reading, extending a period of stability in underlying price pressures. For policymakers at the European Central Bank (ECB), the numbers highlight both progress in the fight against inflation and the risks of moving too soon toward monetary easing.

Persistent but Stable Inflation

Core inflation — which excludes the volatile categories of food and energy — is regarded as a key measure of underlying price dynamics. By holding steady at 2.3% for a third consecutive month, it suggests that disinflation in the euro area is proving slower than some had hoped, even as headline inflation has eased closer to the ECB’s 2% target.

Eurostat will release final headline inflation data later this week. Preliminary estimates indicated that consumer prices rose just above 2% in July, raising questions about whether inflation is entering a plateau rather than continuing a downward trajectory.

Economists React

Analysts said the numbers provide reassurance that inflation is not reaccelerating but also serve as a warning of its persistence. “Stability at 2.3% is good news, but it also highlights the stickiness of services inflation,” said Elena Müller, senior economist at Frankfurt-based consultancy MacroVision. “The ECB will need stronger evidence of disinflation before cutting rates more aggressively.”

BNP Paribas economist Jean-Luc Moreau noted that high borrowing costs could increasingly strain the euro zone’s largest economies. “Germany is already flirting with stagnation, Italy’s debt dynamics are worsening, and household demand is subdued. The ECB risks suffocating growth if it waits too long.”

ECB’s Balancing Act

The ECB raised interest rates to record highs in 2023 as inflation soared above 10%. Since then, it has maintained a restrictive stance, keeping credit conditions tight in order to anchor inflation expectations. Policymakers had hinted earlier this year that rate cuts might be possible in the second half of 2025, but core inflation’s resilience has complicated that narrative.

Investors are now divided on whether the ECB will deliver a modest cut in September or delay action until December. Money market pricing on Wednesday suggested traders now expect only one 25-basis-point reduction before the end of the year.

How Households Are Feeling It

For consumers, the persistence of inflation remains palpable. Services such as housing, hospitality, and healthcare continue to put pressure on household budgets, particularly in Southern Europe. Even in countries where wage growth has accelerated, workers often see real earnings barely keeping pace with rising costs.

“In many member states, people still feel inflation in their wallets every day,” said Sofia Costa, a Lisbon-based consumer advocate. “Stable numbers on a chart don’t change the fact that rents, groceries, and energy bills remain painfully high.”

Global Comparisons

The euro zone is not alone in grappling with stubborn inflation. In the United States, the Federal Reserve faces similar challenges, with core inflation hovering above its 2% target despite aggressive tightening. In the United Kingdom, services inflation remains even more entrenched, raising fears of a prolonged cost-of-living crisis.

By comparison, the euro area’s figures appear relatively stable, but economists stress that structural differences — such as slower wage growth and stricter fiscal rules — make the ECB’s task distinct from that of the Fed or the Bank of England.

Market Reactions

Financial markets reacted calmly to the Eurostat release. The euro held steady against the U.S. dollar, while bond yields across the bloc showed only modest movement. Equities rose slightly in afternoon trading, with banking stocks benefiting from the prospect of prolonged higher interest rates.

“Markets had fully priced in today’s number, but the real story is what comes next,” said Patrick Williams, a strategist at London-based firm CapitalEdge. “If September brings any hint of disinflation in services, expectations for a rate cut could shift quickly.”

Corporate Impact

For businesses, especially small and medium-sized enterprises (SMEs), the persistence of high interest rates is squeezing credit availability. Retailers and service providers continue to face cautious consumer spending, while manufacturers report higher financing costs for investment projects.

“The longer borrowing costs stay high, the harder it becomes for firms to expand,” warned the European Business Council in a statement. “Without relief, we risk a cycle of weak investment and low productivity growth.”

Political Pressures

Inflation has also become a political issue across the continent. In Germany, opposition parties have criticized Chancellor Olaf Scholz’s government for failing to shield households from rising costs. In Italy, Prime Minister Giorgia Meloni faces growing discontent over food prices and energy bills. The political fallout from persistent inflation is expected to weigh heavily on the upcoming European Parliament elections in 2026.

The Bigger Picture

The International Monetary Fund (IMF) has urged the ECB to remain cautious, warning that premature easing could reignite inflation expectations. At the same time, economists stress that overly tight monetary policy risks exacerbating Europe’s already weak growth outlook.

“The ECB is walking a tightrope,” said Müller. “The risk of cutting too soon is inflation resurgence. The risk of waiting too long is a deeper recession.”

Outlook

With inflation holding steady, the ECB’s next policy meeting on September 12 is set to be a critical moment. Analysts say that unless services inflation and wage growth show clearer signs of easing, the central bank is unlikely to deliver more than one symbolic rate cut this year.

For European households and businesses, that means tighter credit conditions are here to stay — at least through the remainder of 2025.