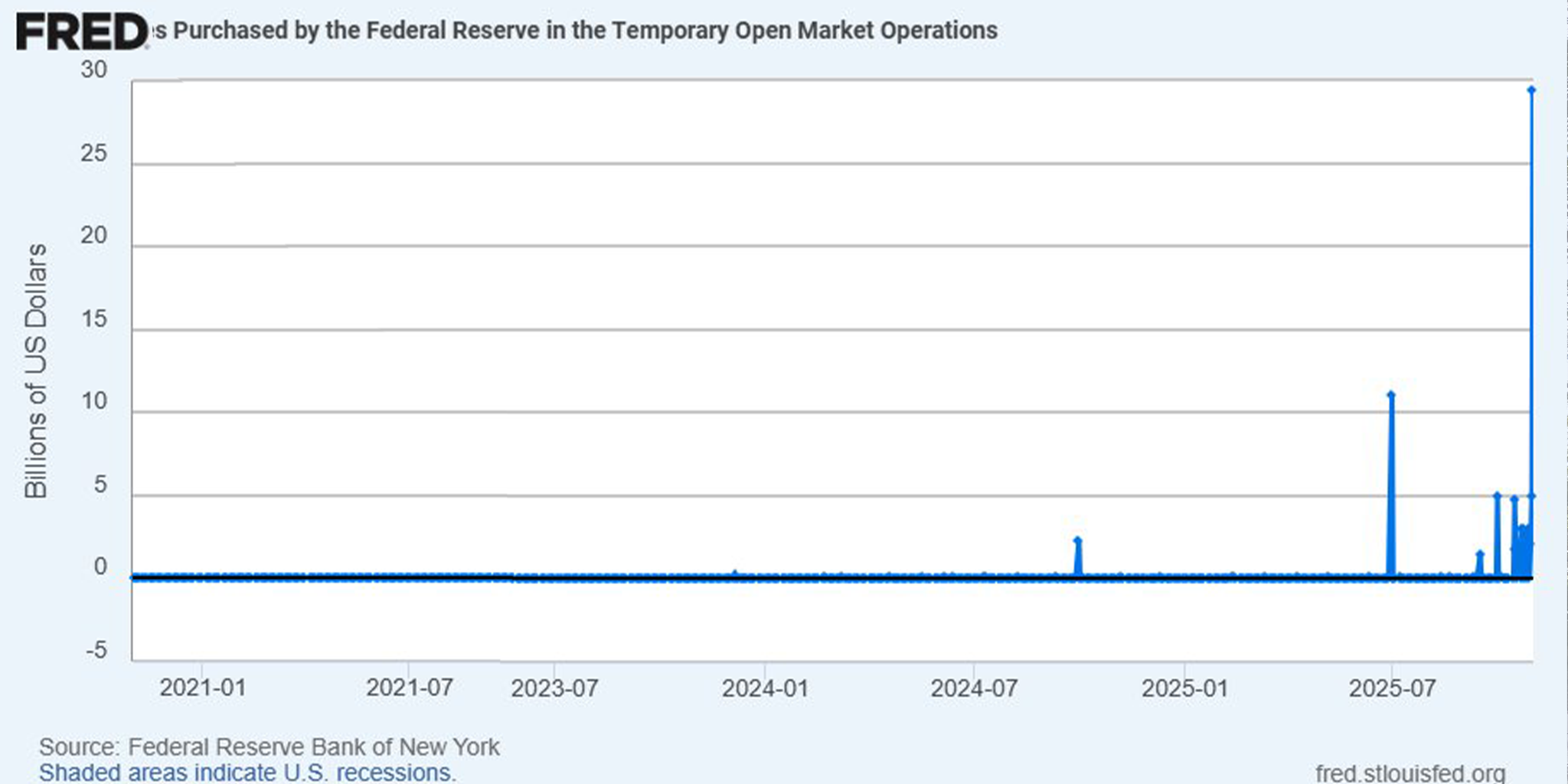

Fed Pumps $29.4 Billion Into Markets Overnight as Liquidity Facility Usage Signals Critical Shift in Monetary Policy

Washington, D.C. – November 1, 2025 — In a development closely watched by financial markets, the Federal Reserve's overnight reverse repurchase agreement (ON RRP) facility has registered approximately $29.4 billion in daily usage, reflecting a dramatic transformation in U.S. money market conditions and the central bank's evolving approach to monetary policy implementation. This figure represents a stunning collapse from the facility's peak usage of over $2.5 trillion in mid-2023, signaling profound changes in liquidity dynamics as the Fed navigates its post-rate cut environment.

1. What Is the Fed's Overnight Reverse Repo Facility?

To understand the significance of the $29.4 billion figure, it's essential to grasp what the overnight reverse repurchase agreement facility actually does and why it matters to financial markets.

The Mechanics

The ON RRP facility is a critical tool in the Federal Reserve's monetary policy implementation toolkit. Here's how it works:

- Daily Operations: Each business day, eligible counterparties can lend cash to the Fed overnight

- Collateral: The Fed provides U.S. Treasury securities as collateral for these loans

- Interest Rate: Currently set at 3.75% following the October 2025 rate cut

- Eligible Participants: Money market funds, government-sponsored enterprises, banks, and primary dealers

- Per-Counterparty Limit: $160 billion maximum per participant per day

The Purpose

The facility serves as a floor for overnight interest rates in the U.S. financial system. By offering a risk-free return backed by the full faith and credit of the U.S. government, the Fed ensures that short-term rates don't fall below its target range. It's essentially a safety valve that absorbs excess liquidity when money market participants have nowhere else profitable to park their cash.

2. The Dramatic Decline: From $2.5 Trillion to $29.4 Billion

The current $29.4 billion usage level represents one of the most spectacular collapses in Fed facility usage in modern central banking history.

The Peak Era (2022-2023)

During 2022 and early 2023, the ON RRP facility experienced unprecedented demand:

- Peak Usage: Over $2.5 trillion in June 2022

- Driving Factors: Massive Fed balance sheet expansion during COVID-19, high policy rates making the facility attractive

- Market Impact: Absorbed enormous amounts of liquidity that might otherwise have pushed rates negative

The Unwind (2023-2025)

Several factors drove the facility's dramatic decline:

- Quantitative Tightening: Fed reducing its balance sheet drained liquidity from the system

- Treasury Issuance: Heavy T-bill supply provided alternative investments for money market funds

- Banking System Absorption: Banks became more willing to accept deposits as reserve levels normalized

- Rate Cut Cycle: Lower ON RRP rates reduced the facility's attractiveness versus private market alternatives

Current State

By October 2025, usage had plummeted to around $28.8-29.4 billion, the lowest level since April 2021. This represents a 98.8% decline from peak levels—an extraordinary reversal that fundamentally alters money market dynamics.

3. The End of Quantitative Tightening: A Watershed Moment

The Fed's October 29, 2025 announcement that it would end quantitative tightening (QT) on December 1 provides crucial context for understanding current ON RRP dynamics.

What Was QT?

Since 2022, the Fed had been shrinking its balance sheet by allowing securities to mature without replacement:

- Treasury Securities Cap: $5 billion per month in runoff

- Agency MBS Cap: $35 billion per month in runoff

- Total Balance Sheet: Declined from nearly $9 trillion to approximately $6.6 trillion

- Purpose: Tighten financial conditions and support inflation fighting

Why End It Now?

The Fed's decision to halt QT reflects several considerations:

- Reserve Levels: Banking system reserves approaching potentially problematic low levels

- Money Market Stress Signals: Occasional upward pressure on repo rates suggesting tightening liquidity

- Rate Cut Transition: Pivoting from tightening to easing monetary policy

- Preventive Action: Avoiding a repeat of September 2019 repo market disruption

Market Implications

Ending QT has significant ramifications for financial markets:

- Liquidity Stabilization: Reserve balances will stop declining, easing funding market pressure

- Equity Supportive: Historically, Fed balance sheet expansion correlates with rising stock prices

- Rate Dynamics: Should reduce upward pressure on short-term funding costs

- Future Expansion?: Some analysts predict Fed may resume asset purchases in 2026

4. The Rate Cut Context: Where Monetary Policy Stands

The ON RRP facility's current state must be understood within the Fed's broader monetary policy pivot toward accommodation.

October 2025 Rate Decision

At its October 28-29 meeting, the Federal Open Market Committee (FOMC) delivered its second consecutive rate cut:

- Action: 25 basis point reduction

- New Target Range: 3.75% to 4.00%

- Vote: 10-2, with dissents from both hawks and doves

- ON RRP Rate: Adjusted down to 3.75% to maintain floor function

Powell's December Uncertainty

Fed Chair Jerome Powell rattled markets by suggesting another December cut is "not a foregone conclusion," citing:

- Elevated Inflation: CPI at 3.0%, well above the 2% target

- Resilient Economy: Growth remaining moderate despite tightening

- Labor Market Balance: Unemployment edging up but job losses contained

- Data Dependence: Fed will assess incoming information before deciding

Market Expectations

Despite Powell's caution, markets had been pricing in additional easing:

- December 2025: ~50% probability of another quarter-point cut

- 2026 Trajectory: Markets expecting 2-3 additional cuts

- Terminal Rate: Fed dots suggesting neutral around 3%

- Equity Reaction: Stock markets hitting all-time highs despite uncertainty

5. What $29.4 Billion Usage Actually Means

The current low level of ON RRP facility usage carries multiple important implications for understanding money market conditions.

Healthy Money Market Functioning

Low ON RRP usage suggests that private markets are functioning effectively:

- Private Repo Market: Money market funds finding attractive opportunities in tri-party repo exceeding $4.5 trillion daily

- Treasury Bill Demand: Ample T-bill issuance absorbing cash that previously went to the Fed

- Bank Deposit Acceptance: Financial institutions comfortable holding customer deposits

- Rate Competitiveness: Private market rates exceeding the ON RRP floor

Absence of Excess Liquidity

Unlike the 2022-2023 period, the financial system is no longer drowning in excess reserves:

- QT Impact: Balance sheet runoff successfully drained liquidity

- Reserve Scarcity: Banking system reserves at levels where marginal dollar matters

- Price Discovery: Interest rates more reflective of genuine supply and demand

- Fed Dependence Reduced: Market participants less reliant on central bank facilities

Potential Warning Signs

However, very low usage also raises potential concerns:

- Reserve Adequacy: Are reserves approaching problematic scarcity?

- Stress Vulnerability: Would the system handle sudden liquidity demands?

- Repo Market Volatility: Recent episodes of secured rates spiking above the Standing Repo Facility rate

- September 2019 Echo: Memories of repo market disruption when reserves grew too scarce

6. The Standing Repo Facility: The Other Side of the Coin

While the ON RRP facility provides a floor for rates, the Standing Repo Facility (SRF) provides a ceiling—and its recent usage reveals important stress signals.

What Is the SRF?

Established in July 2021, the SRF allows eligible institutions to borrow from the Fed overnight:

- Minimum Bid Rate: Currently 4.0%, 25 basis points above the top of the target range

- Aggregate Limit: $500 billion available

- Eligible Collateral: Treasury, agency debt, and agency MBS

- Purpose: Backstop preventing rates from rising too high

Recent Usage Spikes

Unlike the declining ON RRP, the SRF has seen occasional significant usage:

- September 15, 2025: $1.5 billion in take-up as SOFR temporarily exceeded the SRF rate

- Quarter-Ends: Regular usage around reporting dates as rates spike

- Tax Dates: Mid-month liquidity crunches driving temporary demand

- Treasury Issuance: Heavy T-bill supply occasionally straining funding markets

What This Reveals

The divergence between minimal ON RRP usage and occasional SRF activity is telling:

- Asymmetric Liquidity: No excess reserves seeking a home, but periodic shortfalls

- Fed Walking Tightrope: Balance sheet size approaching the edge of "too small"

- QT Endpoint Justified: Wisdom of ending runoff before severe disruption

- Future Balance Sheet Growth: May need expansion to maintain ample reserves

7. Market Implications and Investment Considerations

The evolution of Fed facility usage carries concrete implications for various asset classes and market participants.

For Equity Markets

- Bullish Liquidity Signal: Ending QT historically supportive for stocks

- Rare Fed Easing at Highs: Only four prior instances of rate cuts at all-time highs, averaging 20% S&P 500 gains over next year

- Valuation Concerns: Markets priced for perfection, vulnerable to policy disappointment

- Sector Rotation: Lower rates favoring growth over value

For Fixed Income

- Yield Curve Dynamics: Front-end rates declining with Fed cuts, but long-end sticky

- Money Market Fund Flows: Lower ON RRP rates pushing cash into T-bills and private repo

- Credit Spreads: Ample liquidity supportive of tight spreads

- Duration Strategy: Uncertainty about 2026 cuts complicating positioning

For Money Market Participants

- Rate Shopping: Private repo offering better returns than ON RRP floor

- T-Bill Focus: Heavy Treasury issuance providing attractive alternatives

- Quarter-End Management: Preparing for periodic rate spikes

- Counterparty Risk: Balancing returns against credit exposure

For Banks

- Deposit Competition: Need to retain funding as alternatives emerge

- Reserve Management: Optimizing Fed funds lending versus holding excess reserves

- NIM Pressure: Rate cuts compressing net interest margins

- Liquidity Planning: Ensuring adequate buffers for stress scenarios

8. Historical Context: Why This Matters

Understanding where we've been helps clarify where we might be heading.

The Pre-2020 Normal

Before COVID-19, the ON RRP facility saw minimal usage:

- Typical Daily Volume: Less than $100 billion

- Reserve Framework: "Ample reserves" regime with $1.5 trillion in system

- Money Market Stability: Generally smooth functioning

- September 2019 Exception: Temporary disruption when reserves grew too scarce

The COVID Surge (2020-2021)

Pandemic response drove unprecedented Fed expansion:

- Balance Sheet Explosion: From $4 trillion to $9 trillion

- Reserve Flood: Over $4 trillion in banking system reserves

- ON RRP Liftoff: Usage climbing from near-zero to $2+ trillion

- Zero Rates: No alternative investments for cautious cash

The Normalization (2022-2025)

Inflation fighting drove reversal:

- Aggressive Rate Hikes: From 0% to 4.25-4.50% peak

- Quantitative Tightening: $95 billion monthly balance sheet reduction at peak

- ON RRP Decline: From $2.5 trillion back toward pre-pandemic levels

- Today's $29.4 Billion: Approaching but not yet at historical norms

9. Looking Ahead: What Comes Next?

Several scenarios could unfold from current conditions.

Scenario 1: Stable Equilibrium

Most likely outcome according to Fed officials:

- ON RRP Stabilization: Usage remains low but positive

- Balance Sheet Plateau: Assets steady around $6.6 trillion

- Gradual Rate Cuts: 1-2 more cuts through mid-2026

- Smooth Functioning: Money markets operate without significant stress

Scenario 2: Reserve Scarcity Crisis

Bears worry about repeating 2019:

- Sudden Rate Spikes: Repo markets seizing up as reserves grow too scarce

- Emergency Fed Action: Restarting asset purchases to inject reserves

- Market Volatility: Funding stress spreading to equities and credit

- Policy Credibility: Questions about Fed's balance sheet management

Scenario 3: Early Expansion

Some analysts predict proactive Fed action:

- 2026 QE Restart: "Organic growth" purchases to maintain ample reserves

- Permanent Floor System: Fed accepting structurally larger balance sheet

- Equity Rally: Balance sheet expansion driving risk asset gains

- Currency Implications: Dollar weakness from easier policy

10. Conclusion: A Critical Juncture for Monetary Policy

The Federal Reserve's overnight reverse repo facility usage settling around $29.4 billion represents far more than an obscure technical indicator—it's a critical signpost revealing the fundamental transformation underway in U.S. monetary policy and money market dynamics.

The 98.8% collapse from peak usage demonstrates that the Fed's quantitative tightening program successfully drained the excess liquidity that characterized the COVID era. The financial system is no longer awash in reserves seeking a safe haven at the central bank. Private markets are functioning, Treasury issuance is absorbing cash, and banks are comfortable with their funding profiles.

But this success brings new challenges. The Fed now walks a tightrope between maintaining "ample reserves" and allowing scarcity to develop. The decision to end quantitative tightening on December 1 reflects this delicate balance—proceeding further risks a disruptive funding crisis similar to September 2019.

For investors, the implications are profound:

- The end of QT is historically bullish for risk assets

- Low ON RRP usage signals healthy private market functioning

- Occasional SRF usage warns that reserves are approaching scarcity thresholds

- The Fed may need to restart balance sheet expansion sooner than expected

As Chair Powell navigates between competing priorities—supporting employment without reigniting inflation, maintaining financial stability without excessive intervention—these money market indicators will provide crucial real-time feedback about whether policy is appropriately calibrated.

The $29.4 billion figure may seem technical, but it tells a powerful story: The Fed's extraordinary pandemic-era interventions have been largely unwound, and the central bank is entering a new phase where the risk is no longer too much liquidity, but too little.