Euro Zone July Core Inflation Holds at 2.3%

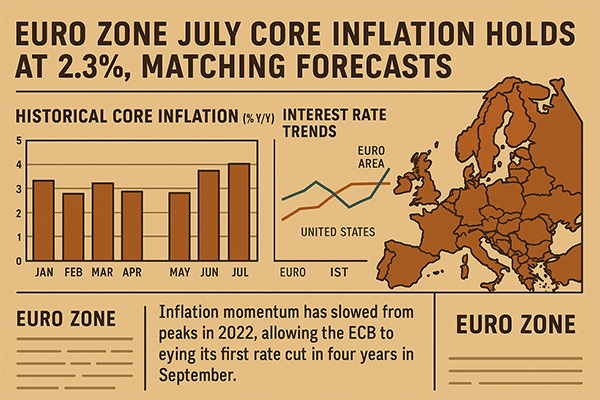

Euro Zone July Core Inflation Holds at 2.3%, Matching Forecasts

Brussels, August 20, 2025.

The euro zone’s core inflation rate remained unchanged at 2.3% year-on-year in July, according to Eurostat data released Wednesday. The figure was exactly in line with forecasts and with the previous month’s reading, extending a period of stability in underlying price pressures. For policymakers at the European Central Bank (ECB), the numbers highlight both progress in the fight against inflation and the risks of moving too soon toward monetary easing.

Persistent but Stable Inflation

Core inflation — which excludes the volatile categories of food and energy — is regarded as a key measure of underlying price dynamics. By holding steady at 2.3% for a third consecutive month, it suggests that disinflation in the euro area is proving slower than some had hoped, even as headline inflation has eased closer to the ECB’s 2% target.

Eurostat will release final headline inflation data later this week. Preliminary estimates indicated that consumer prices rose just above 2% in July, raising questions about whether inflation is entering a plateau rather than continuing a downward trajectory.

Economists React

Analysts said the numbers provide reassurance that inflation is not reaccelerating but also serve as a warning of its persistence. “Stability at 2.3% is good news, but it also highlights the stickiness of services inflation,” said Elena Müller, senior economist at Frankfurt-based consultancy MacroVision. “The ECB will need stronger evidence of disinflation before cutting rates more aggressively.”

BNP Paribas economist Jean-Luc Moreau noted that high borrowing costs could increasingly strain the euro zone’s largest economies. “Germany is already flirting with stagnation, Italy’s debt dynamics are worsening, and household demand is subdued. The ECB risks suffocating growth if it waits too long.”